When TikTok went down in the U.S. for less than a day in January — before its ban would have taken effect — commerce-first social platform Orme “got a rush of people downloading the app, and they wanted to upload videos,” co-founder and CEO Faisal Ahmed told Digital Commerce 360.

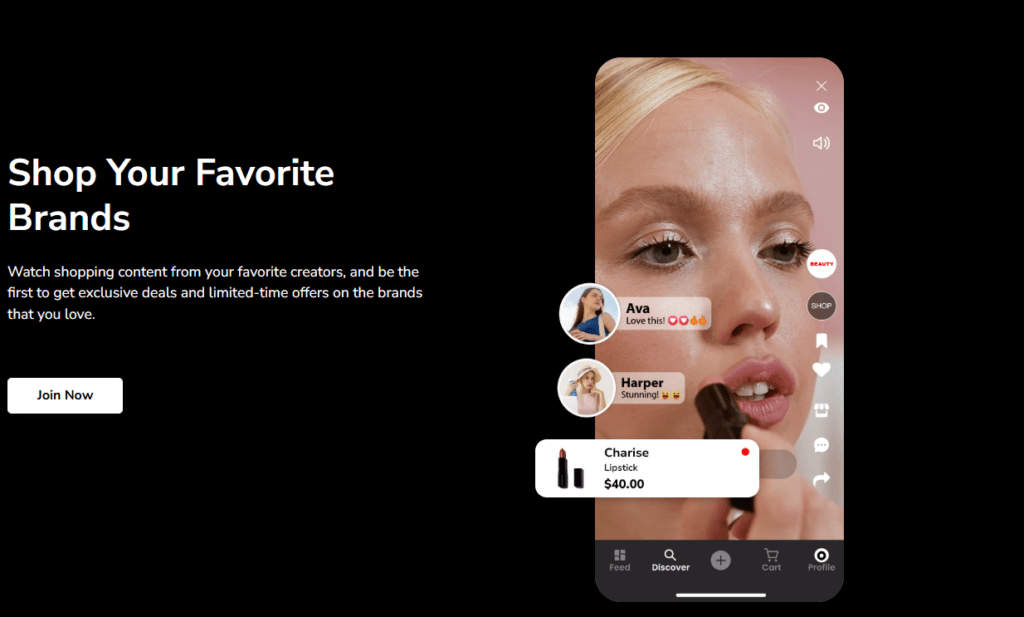

Orme is both an online marketplace and a social media platform. It shows users a feed of videos based on their interests, much like on TikTok and Instagram Reels.

Orme differs from TikTok and Instagram Reels in that each video displays at least one product users can buy, and they do so directly from a video page, without pulling up an in-app browser or being directed off the app. Additionally, for every item a user buys on Orme, the creator of that video gets a commission. If another user reshares that video, both that user and the original creator receive commissions for items sold via the reshared video.

And although that’s Orme’s model as an online marketplace — all videos on the platform must be shoppable — it made changes to accommodate “TikTok refugees.”

Its changes include adding non-shoppable videos and pivoting its merchandise focus. And Orme has already learned from them, Ahmed and co-founder Robert D’Loren told Digital Commerce 360.

Orme sees spike in users amid TikTok ban discussions

Orme is less than a year old, having gone live in April 2024. Xcel Brands, which owns brands including Halston and Longaberger, launched Orme as “a joint venture with a technology company in which Xcel owns a 30% interest in this new video and social commerce marketplace,” said D’Loren, who also is chairman and CEO of Xcel, told investors in a mid-2024 earnings call.

Now, “Orme is off to a good start with nearly 30,000 users,” D’Loren told investors in December 2024 on an Xcel Brands earnings call.

When TikTok shut down service before a deadline on Jan. 19, it left a temporary void for other platforms to try to fill. Among the most popular was another Chinese social media app, RedNote, which many TikTok users had installed in anticipation of the shutdown.

But U.S.-based Orme gained traction as well. In the days surrounding the shutdown, Orme had grown its user base around 15%, which Ahmed directly attributed to the TikTok ban talk.

Effect of the TikTok ban on Orme videos

To accommodate the new users, who wanted to upload videos, Orme made an app change that allowed its users to post non-shoppable videos.

That didn’t last long, Ahmed and D’Loren said.

“That was sort of a misstep,” Ahmed said, adding that, “It was just social media posts.”

After a few days, Orme decided to revert to its original shoppable-video-only model. In doing so, it set up a new content filter. Users must now have at least 1,000 followers on Orme before they can create new content for the app. However, any user can still repost content that an influencer with 1,000+ followers has created.

“We are a commerce-first social site, not a social site, commerce second,” D’Loren told Digital Commerce 360. He added, “I will say, for those three or four days, there was some interesting content.”

Additionally, Orme was never directly competing with TikTok, Ahmed said.

“Obviously, them going dark put some spotlight on us, but we are going after brands,” he added. “For example, all the brands which are on TikTok Shop are low- to medium-value brands.”

Orme makes a beauty-focused change

“It’s always been our intention to attract brands that are in the better- to premium zone; not true luxury, European luxury brands, but better to premium,” D’Loren said. “Usually, better to premium brands have higher average order values. We’re not trying to play down in that low ticket, $20, $25.”

As of January 2025, Orme has pivoted to putting its efforts toward primarily selling products from beauty brands. Apparel and other retail brands already on the app will remain there, D’Loren said, but over time, Orme will become dedicated to the Health & Beauty category.

“That will enable us to create content that is not only there to demonstrate what beauty is, which really lends itself perfectly to video commerce, but also the platform becomes a place for exploration beyond earning,” he added.

Clothing, shoes and handbags all have high return rates compared to beauty products, Ahmed said.

“Most beauty brands have good content that can be loaded up on the platform,” D’Loren explained. “Some of the brands that came on that are major apparel brands had literally no content.”

After onboarding a rush of users amid a looming TikTok ban, video commerce platform Orme has also made the decision to pivot its merchandise focus to beauty products.

Orme has a trick up its sleeve: livestreaming

Although Orme has not deployed it yet, D’Loren told Digital Commerce 360 the platform has the capability of livestreaming television channels.

Shopping channels QVC and HSN are “very important strategic partners to Xcel,” D’Loren said. “We’re one of their largest vendors. They’re one of our largest retail partners.”

Xcel Brands and QVC Group, which owns QVC and HSN, share information with one another, he added.

“They, of course, are looking at short-form video and social commerce because they know their challenge is that cable distribution is shrinking every year as people cut cable,” D’Loren said. “We’ve kept them informed about everything they’re doing. We did build into Orme, which is also unique to the platform, the ability to accept livestreaming from any television network so that Orme itself could become a streaming network.”

QVC Group rebranded from its previous name, Qurate Retail Group, in part to capitalize on the brand awareness of its television network and website. It ranks No. 38 in the Top 1000. The database is Digital Commerce 360’s ranking of the largest North American online retailers by their annual ecommerce sales.

“When you think about QVC and HSN, they’re marketing on streaming platforms but how many people are really turning to Netflix, Sling or any other streaming network to shop? But if they could stream live their feeds all day on a platform that could tie into inventory in real time, then they have a new streaming platform that was built from a commerce-first perspective,” D’Loren said.

And the channels already make long-form content all day, every day, he added.

Do you rank in our databases?

Submit your data and we’ll see where you fit in our next ranking update.

Sign up

Stay on top of the latest developments in the online retail industry. Sign up for a complimentary subscription to Digital Commerce 360 Retail News. Follow us on LinkedIn, X (formerly Twitter), Facebook and YouTube. Be the first to know when Digital Commerce 360 publishes news content.

FavoriteThe post How talk of a TikTok ban changed video commerce platform Orme’s direction appeared first on Digital Commerce 360.

from Digital Commerce 360 https://ift.tt/TcOCian

0 Comments